In the fast-paced logistics and transport industry, managing cash flow can be just as critical as delivering cargo. Freight companies often wait weeks — even months — to receive payments after completing deliveries. This delay can disrupt operations, especially for businesses handling high-volume, cross-border shipments. That’s where freight factoring becomes an invaluable solution.

But what is freight factoring, how does it work, and why is it particularly useful for logistics hubs like Dubai? Let’s explore.

What Is Freight Factoring?

Freight factoring is a financing service that enables trucking and transport companies to sell their unpaid invoices to a third-party factoring company in exchange for immediate cash. This gives businesses access to working capital without taking out loans or accumulating debt.

Whether you’re transporting Dubai to Qatar cargo or managing local deliveries, this approach helps ensure smooth operations by eliminating long waits for payment.

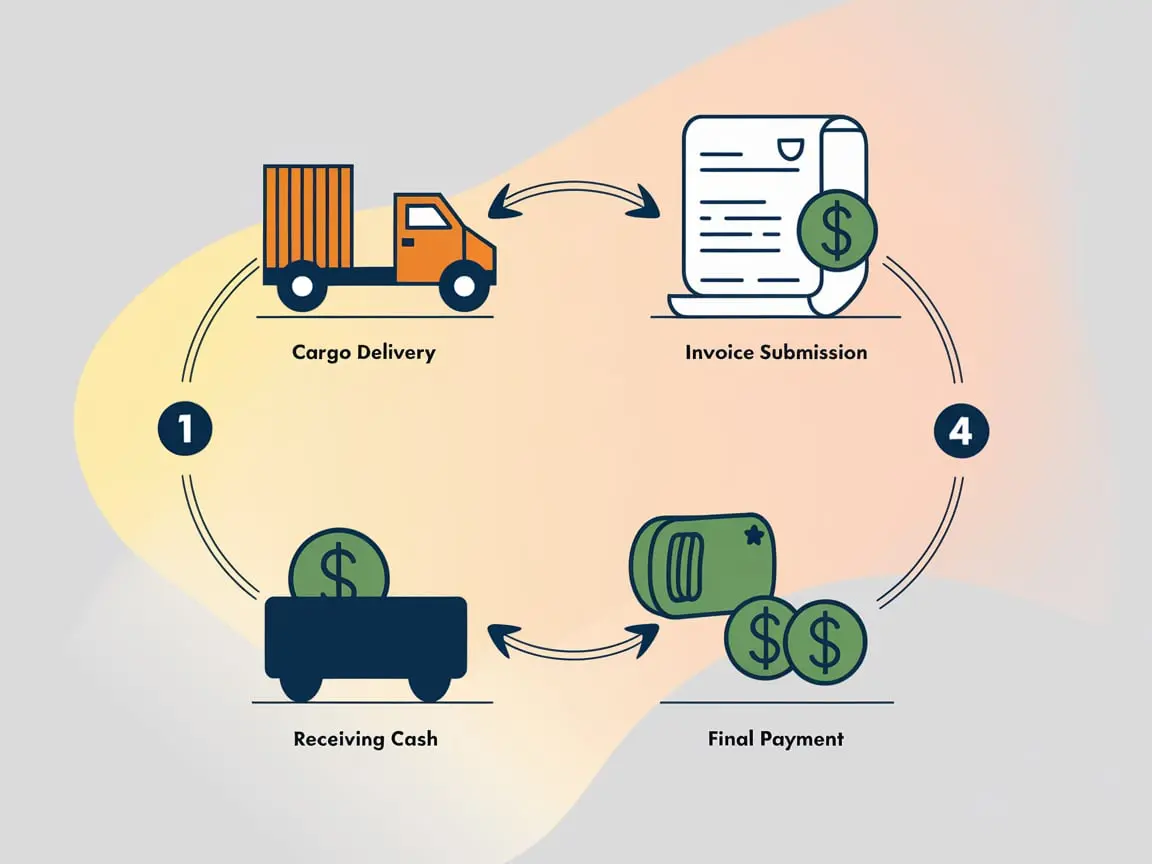

How Does It Work?

- Invoice Submission: After completing a delivery, the freight company sends the invoice to a factoring company.

- Advance Payment: The factoring company pays 80–95% of the invoice value within 24 to 48 hours.

- Client Payment: The client pays the full amount to the factor over the standard term (e.g., 30 or 60 days).

- Remainder Paid Out: The factoring company then sends the balance (minus their service fee) to the freight company.

This model is especially beneficial for companies running high-volume shipping between regions, such as Dubai to Kuwait cargo, where client payment terms can often exceed a month.

Why Is Freight Factoring Beneficial?

Freight factoring offers several key advantages:

- Faster Cash Flow: Immediate access to funds after deliveries.

- No Debt Incurred: It’s not a loan, so your balance sheet stays clean.

- Simplified Collections: The factoring company handles payment follow-ups.

- Fueling Growth: Use working capital for vehicle maintenance, hiring, or taking on more shipments.

For businesses dealing with complex routes and long lead times — like Dubai to Saudi cargo shipments — cash-on-hand can mean the difference between meeting demand or losing a contract.

Freight Factoring in the GCC: Why It Matters

The Gulf region is a key player in regional and global freight movement. With thousands of loads moving across borders weekly, especially via road freight, factoring allows logistics companies to operate without cash flow bottlenecks.

Whether you’re shipping raw materials, electronics, or FMCG products across GCC countries, freight factoring lets you manage large invoice volumes while maintaining operational flexibility.

Some of the top shipping companies in Dubai already incorporate factoring into their business models to streamline finances, reduce administrative burden, and grow more aggressively in competitive markets.

Integrating Factoring With Overall Freight Operations

Freight factoring doesn’t replace your financial system — it enhances it. You can combine it with other tools like fleet management software, route optimization platforms, and accounting solutions for a fully integrated logistics business.

Factoring is also customizable. You can choose recourse (you take the risk if the client doesn’t pay) or non-recourse (the factoring company assumes the risk). For companies just expanding into regional freight — particularly across the UAE and the Gulf — factoring offers a strategic way to reduce exposure and improve cash predictability.

Final Thoughts

So, what is freight factoring? It’s a practical and efficient financing method that keeps freight businesses moving — literally and financially. Whether you’re moving Dubai to Kuwait cargo, transporting goods from Dubai to Qatar, or managing Dubai to Saudi cargo, factoring ensures you don’t have to wait for payments to fuel your growth.

And as logistics hubs like Dubai continue to rise, partnering with top shipping companies in Dubai and leveraging modern financial solutions like freight factoring is more crucial than ever.